The Gist

Claims management processes, whether wholly manual or partially automated, drag down the efficiency of providers’ operations and can even lead to negative outcomes for patients. An intelligent claims automation AI solution that combines artificial intelligence (AI), machine learning (ML), and expert human support can lead to significantly better outcomes.

Claims management has long been a concern for healthcare providers and revenue cycle teams. Denials, prior authorization requirements, and many other factors require staff to dedicate additional time and resources to resolve problems and, ultimately, secure the revenue their hospital or health system deserves.

Effective, accurate, and reliable automation can play a pivotal role in empowering an organization to get to payment faster and more consistently. With the right automation solution in place, staff can steer their efforts toward the issues that require uniquely human talents.

At the same time, a combination of artificial intelligence (AI), machine learning (ML), and targeted support from revenue cycle experts can address a bulk of tasks related to processing claims and handle them effectively.

The clean claims rate is the most popular metric for measuring success in terms of claims management. Let’s take a closer look at the difficulties that metric can introduce and the role AI can play in realizing positive change.

In my experience, metrics like clean claims can lead executives to believe they are performing better than they actually are, only to see their rate of initial denials is still high.

~ Amy Raymond, VP of Revenue Cycle Operations at AKASA

Challenges in Attaining Higher Clean Claims and Where AI Fits in

While many providers measure the difference between clean claims and initial denials and use it as a key metric, this approach has its limitations.

Clean claims represent an expectation: that the claim is ready for processing and payment.

If payers deny a significant number of claims that are considered clean, the clean claim-initial denial metric may not tell the whole story. With more than 75% of providers using this measurement, according to an HFMA survey of provider CFOs and revenue cycle leaders, commissioned by AKASA, it’s important to consider the alternatives.

Instead, organizations should use first-pass payments — the number of claims paid on the first attempt — as a foundational metric in claims management. By tracking outcomes instead of expectations, organizations can more accurately determine performance.

Shifting the organization’s focus to actively managing performance against first-pass payments provides one metric that accurately measures performance. Efforts to improve first-pass payments will, by default, also improve clean claims and initial denial metrics as well.

~ Amy Raymond, VP of Revenue Cycle Operations at AKASA

Where do AI and intelligent automation fit into attaining a higher clean claim rate?

The automation of administrative tasks related to claims has saved the industry as a whole an annual total of $122 billion, according to the Council for Affordable Quality Healthcare. However, further opportunities for automation could lead to additional annual savings of $16.3 billion by fully automating some common processes.

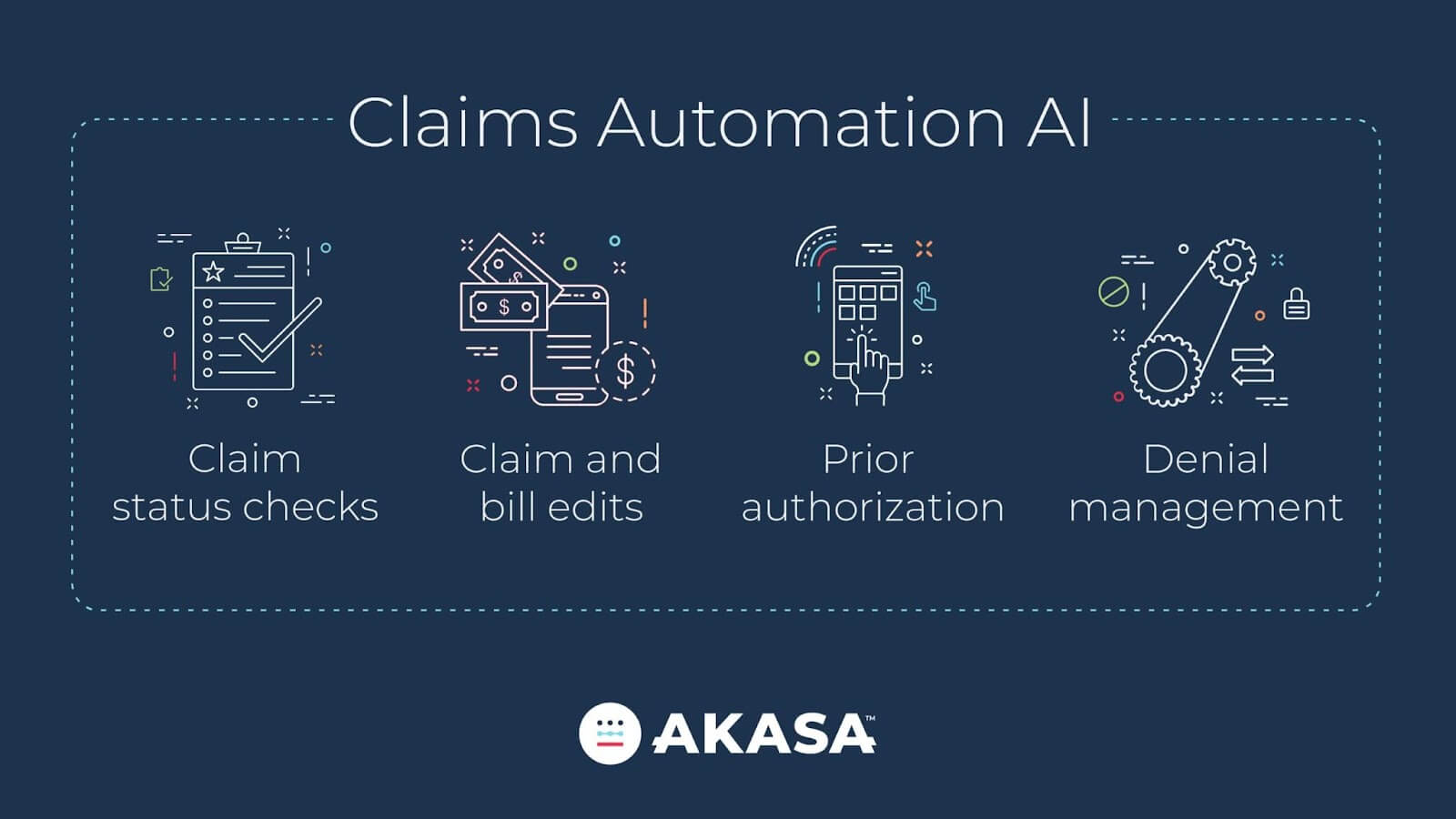

Where can your organization apply claims automation AI to realize greater savings? Areas of opportunity for automated claims processing include:

- Claim status checks

- Claim and bill edits

- Prior authorization

- Denial management

Finding areas of opportunity where claims automation can make the biggest difference in your organization is crucial. However, addressing common pain points like prior authorization and denial management can support better outcomes for the vast majority of providers.

~ Amy Raymond, VP of Revenue Cycle Operations at AKASA

AI Capability #1: Claim Status Checks

A claim lacking any response may be even worse than a rejection — in the sense that a rejected claim is at least returned to a provider for adjustment and potential payment. A claim without a payer response sits in a state of uncertainty until the payer eventually addresses it or the provider reviews and escalates.

When performed manually, this follow-up workflow can require significant attention. A single claim status check takes an average of eight minutes, according to our latest report on “New Productivity Benchmarks for the Healthcare Revenue Cycle.”

AI-driven automation, however, can drastically improve that number for revenue cycle teams. AKASA’s advanced technology and Claim Status product can complete a comprehensive follow-up to payer responses by taking account information from an EHR or patient accounting system and checking the payer portal. Machine learning helps AKASA determine the right time and frequency to check and recheck per payer. By using multiple interface methodologies and ML, AKASA obtains more robust data sets, such as service line-level or payment information detail.

Plus, the technology does more than just bring back the status. It helps take the next step, such as managing a denial, rebill, appeal, or more.

By automating claim status, you can focus staff on the more complex claims — rather than time-consuming, manual mundane tasks. Ultimately, this helps reduce A/R days, reduce timely filing denials, and increase employee satisfaction.

AI Capability #2: Claim and Bill Edits

Revising a claim to address EHR system rules or errors due to individual payer requirements is crucial for securing revenue. But each task takes up your team’s valuable time. It also wastes valuable time in getting the claim to the payer, pushing you closer to a filing limit and delaying payment.

Our analysis of customer data found manual EHR claim edits take slightly more than 10 minutes each to complete manually, while a single manual payer-specific edit requires close to six minutes.

A Unified Automation claims solution has the power to not only complete many of these edits without any staff supervision or input, but also to adapt and handle a broader range of edits over time. Everything from modifying fields, reading insurance cards and updating records, sending requests for information to patients, updating codes, and rebilling corrected claims.

AI Capability #3: Prior Authorization

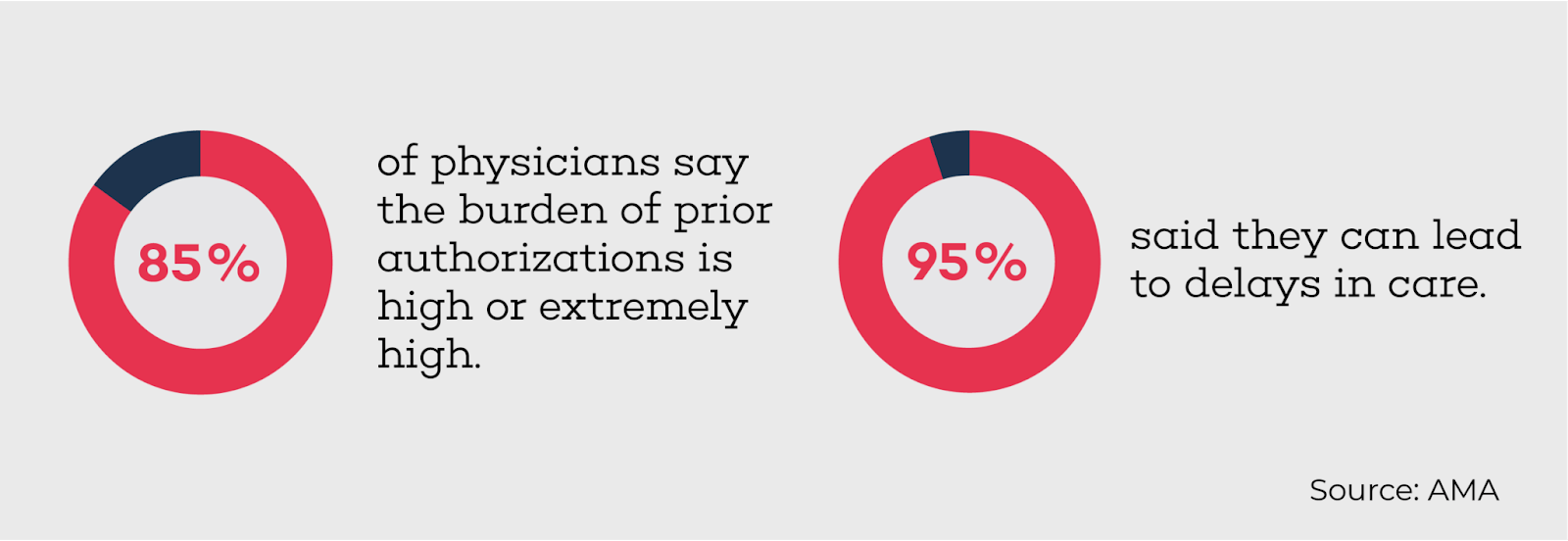

Prior authorization is one of the most difficult issues for providers to navigate. An American Medical Association survey found 85% of physician respondents classified the burden of prior auth as “high” or “extremely high,” and 94% said the process can lead to delays in care.

With a more advanced form of automation, your organization can confidently complete this vital workflow by making tasks like authorization initiation and status checks automatic. At the same time, you can reduce the potential for patients to experience affected health outcomes by delays in the process.

With our Authorization Management product, hospitals and health systems can holistically automate prior auth. AKASA determines if prior authorization is required, gathers the necessary information and clinical documentation, submits the authorization request to payers, checks on the status of those requests, and documents the results. As a result, you can avoid denials, receive more timely reimbursement, increase patient satisfaction, and reduce the risk of delayed appointments or rescheduled care, all with fewer staff frustrations.

Read more about how to speed up your prior auth workflows.

AI Capability #4: Denial Management

Dealing with denials is critical for capturing as much revenue as possible, but rising denial rates make this business process even more time-consuming. However, the process of adjusting and resubmitting claims doesn’t have to fall solely on your staff. An automated approach can offer consistent and positive results, as well as give valuable time back to your team.

AKASA enables your team with the information, tools, and analysis to prevent denials through our state-of-the-art predictive analytics, driven by machine learning. A robust dashboard identifies the cause for denials, allows you to track trends, and communicates information to specific practices and individuals. This type of tool can play a critical role in updating processes upstream that will avoid denials or identifying workflows that should be automated.

Creating a More Efficient Revenue Cycle

Weaving AI and ML technology into the healthcare revenue cycle results in more efficient and effective processes. Organizations can focus staff on the claims that need their expert attention — not on manual mundane tasks. This helps decrease A/R days, reduce timely filing denials, improve cash flow, and increase overall staff satisfaction.

AKASA can help address the claims and general revenue cycle management processes related to claims that providers must constantly complete.

To learn more about how to improve your operational efficiency, create more positive patient experiences, and become a better steward of the healthcare dollar, schedule a demo today.