The Gist

The COVID-19 pandemic drastically altered how people seek care, with telehealth options increasing in popularity. Will this trend maintain, or will people change how they seek care? A survey commissioned by AKASA shines light on what the future could hold for healthcare.

While the U.S. experiments with how best to reopen after shelter in place orders are eased, healthcare providers across the country are grappling with similar care and revenue cycle challenges, and, in many cases, setting the example for the rest of their communities to follow.

Decisions on how quickly to scale-up operations and bring back furloughed workers is a delicate balance and one that needs to be informed by insights into the attitudes of consumers. Most health systems have seen revenues cut in half due to COVID-19. As a result, major disconnects between offering services and when consumers will be ready to use those services could be financially devastating.

AKASA commissioned an online survey of more than 5,000 consumers designed to assess how soon Americans will be comfortable returning to routine care once shelter in place orders are lifted. The survey also assessed consumer concerns related to the cost of COVID-19 testing and treatment.

When is Routine Care Becoming Routine Again?

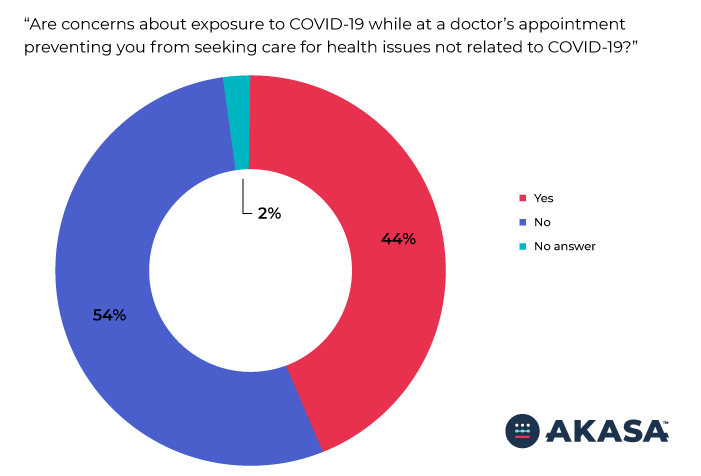

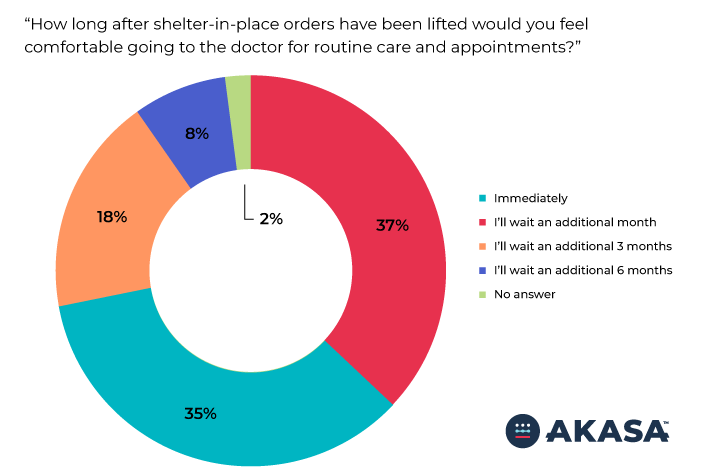

More than 60 percent of survey respondents indicated they would wait between one to three months after shelter in place orders are lifted to seek routine care. Survey respondents were split regarding their current comfort in seeking care for health issues not related to COVID-19, with 44 percent reporting that concerns about exposure to COVID-19 at a doctor’s office are preventing them from seeking care while just over half (54 percent) indicated that such concerns are not preventing them from seeking care for health issues not related to COVID-19.

The survey results exemplify that consumer sentiment towards how and when to re-engage with healthcare providers can sometimes be conflicting, adding to the challenging market conditions health systems have to navigate as they prepare to phase back in routine care and elective procedures. The ability to forecast utilization of services offered is critical for right sizing how these organizations bring back furloughed staff and ramp up operations.

We expect to see patient demand return in waves when health systems return to routine and elective services. Health system executives, including revenue cycle leaders, are facing unprecedented volatility in work volumes, making it very challenging for them to staff their teams appropriately. Many health systems have also experienced crippling declines in revenue as they halted routine and elective procedures to direct the necessary resources to their COVID-19 response. As a result, healthcare providers are under immense financial pressures making their revenue cycle operations more critical than ever before.

~ Malinka Walaliyadde, Co-Founder and CEO of AKASA

Survey respondents were asked, “Are concerns about exposure to COVID-19 while at a doctor’s appointment preventing you from seeking care for health issues not related to COVID-19?”

More than one third (35 percent) of Americans report being willing to seek routine care immediately after shelter-in-place orders are lifted, while more than a third (37 percent) plan to wait at least one month longer and more than a quarter of respondents (26 percent) will wait 3 months or more.

Leaning into automation and other technologies may seem counterintuitive at the moment. However, these tools are crucial to an organization’s ability to ensure business continuity and staffing flexibility during large swings in work volumes. Health systems will inevitably find that they are overstaffed and then understaffed during different periods of time. Revenue cycle managers are facing the dual challenges of minimizing stress on their teams and mitigating the need to hire and fire as their organizations navigate uncertainty and volatility in the market.

~ Varun Ganapathi, Chief Technology Officer and Co-founder at AKASA

Health systems will be looking to revenue cycle leaders to ensure their financial viability in both the near and long term. With approximately 40 million Americans filing for unemployment benefits in recent weeks, health systems are experiencing or may soon experience significant and unfavorable changes to their payer makeup as their Medicaid patient pools are likely to expand and a greater percentage of patients may be uninsured entirely. Revenue cycle teams are having to adapt their operations in real-time while also advising their leadership on the longer-term cost restructuring that will be required as a result of these market dynamics.

A Cautious Future for Healthcare

As the survey data implies, Americans are going to be thoughtful about returning to preventative and elective care. Automation applied throughout revenue cycle operations can help health systems navigate the inevitable fluctuations in volumes and fiscal exposure.

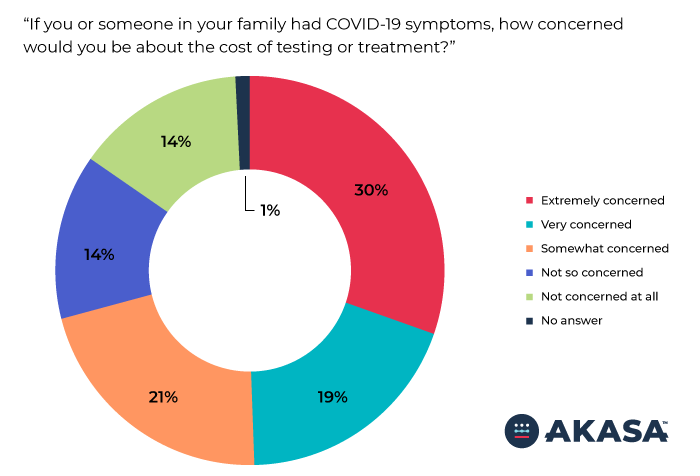

The survey results also show that 70 percent of Americans have concerns about the cost of COVID-19 testing and treatment. Fortunately, the survey results also indicate that these concerns would not prevent the majority of Americans from seeking care should they need it. However, one in five Americans (22 percent) indicate that cost concerns would prevent them from seeking testing and treatment for COVID-19 symptoms. This could significantly hinder public health efforts to effectively address the disease.