The Gist

How can automated claims processing make revenue cycle management (RCM) more efficient? Claims denials have been rising in recent years as hospitals and health systems have grappled with numerous changes in payer rules and coding. But most existing approaches to claims processing, whether manual or automated, can’t navigate this complex maze. Only AI and machine learning, combined with human expertise, can help providers complete the entire claims process and get to payment faster despite the significant current challenges.

Let’s begin with a fundamental question: What is the revenue cycle designed to accomplish?

Although RCM operations have been profoundly changed by EHRs, automation, and artificial intelligence (AI) over the years, the underlying objective has been constant: Get paid accurately for services, as quickly as possible. That requires optimizing how many claims get paid the first time around, encapsulated in a metric called first-pass claims payment.

Read more about why revenue cycle automation experts at AKASA recommend health systems focus on first-pass payments as a key performance indicator.

RCM is often behind the curve in staffing. It’s constantly playing catch up to staff appropriately to changing trends in healthcare and the needs of the revenue cycle.

~ Amy Raymond, VP of Revenue Cycle Operations at AKASA

The Problems with Getting to Payment: Claims in Flux, Staff Under Pressure

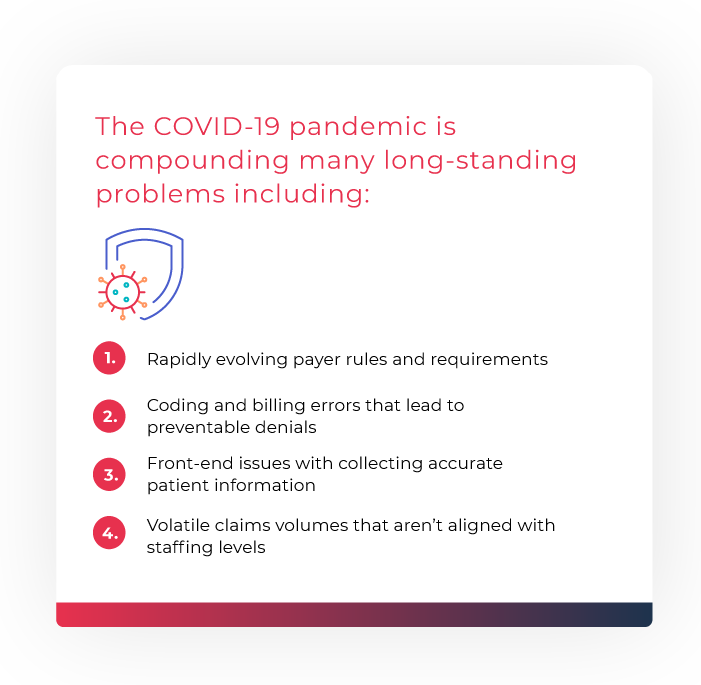

Major obstacles have always stood between providers and this seemingly straightforward goal of first-pass payment. Unfortunately, the COVID-19 pandemic is only adding to these problems.

Indeed, revenue cycle leaders identified erratic claims volumes and coding confusion as among the biggest detriments to their revenue cycle operations in 2020, per an AKASA-commissioned study. At that time, many healthcare organizations were overstaffed due to a sudden decline in overall claims in the wake of COVID-19 and were required to lay off staff members because of the volume decrease.

More recently, though, patient and claims volumes have rebounded and will likely exceed 2019 levels by 2022, according to McKinsey. This reversal could create issues with understaffing, or at the very least team workload management, as staff navigate the unique procedural complexity of the revenue cycle — all while relying on aging, mostly manual tools and processes that lack workflow automation and don’t scale to the evolving challenges at hand.

Dealing with complex payer-side changes, communication delays, and inaccurate information capture and entry, under such pressure, is daunting enough on its own — before even factoring in the additional strain from these fundamentally inadequate approaches to RCM.

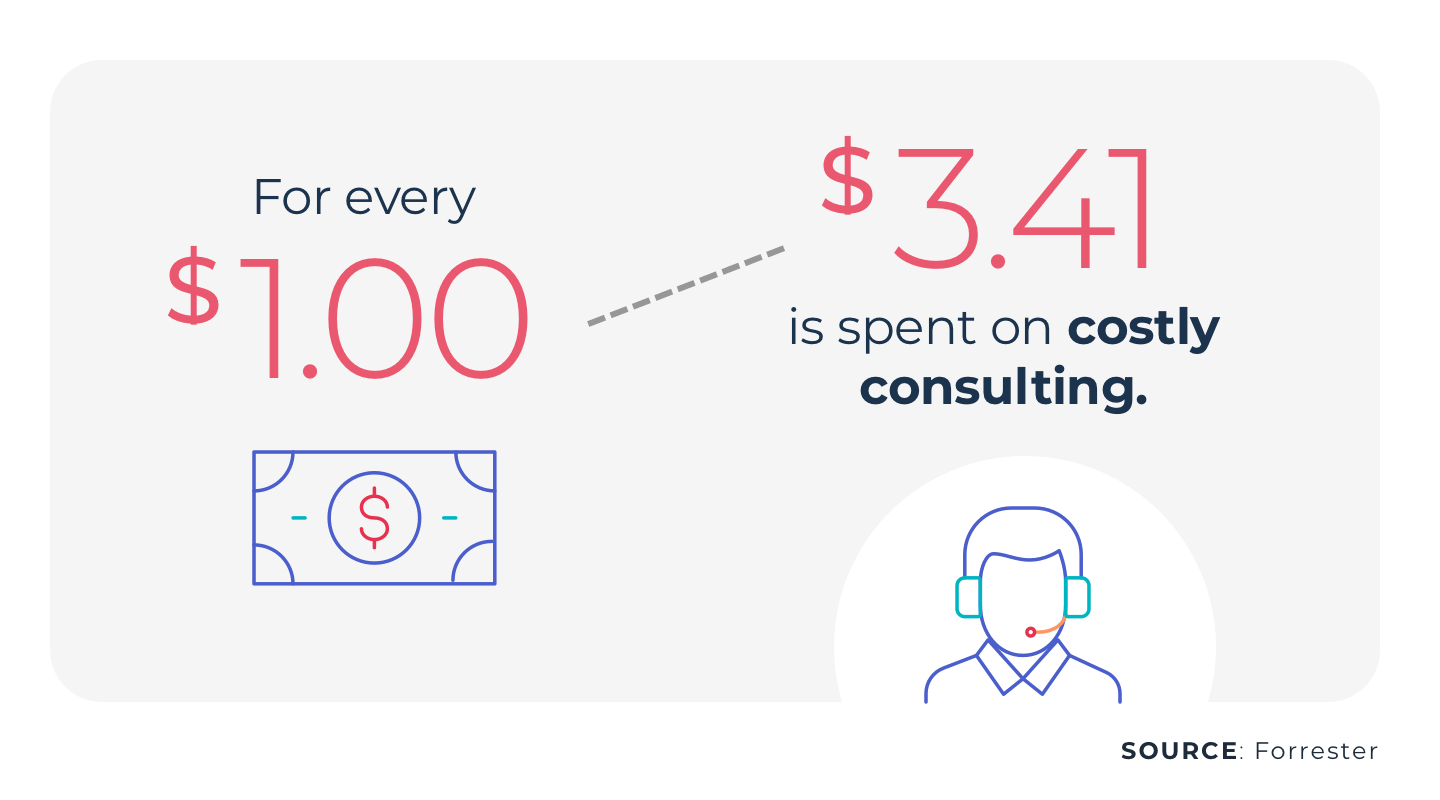

Revenue cycle solutions haven’t always made life easier for human staff as they move through the claims processing workflow, frequently entailing an expensive, low-ROI combination of consultants, outsourcing, and only nominal automation, like traditional robotic process automation (RPA) bots that struggle with complex tasks.

The result: a healthcare claims process workflow that falls short when evaluated against the first pass claims payment metric, translating to a more frequently denied claims lifecycle and reduced revenue as payments gets delayed or lost altogether.

RCM is often behind the curve in staffing. It’s constantly playing catch up to staff appropriately to changing trends in healthcare and the needs of the revenue cycle.

~ Amy Raymond, VP of Revenue Cycle Operations

How Healthcare Claims Processing Slows Payment and What to Do About it

Traditional healthcare claims processing needs substantial improvement, for three primary reasons:

- The claims management process is inherently complicated, encompassing a vast range of possible causes of denials, ranging from failure to file on time to even minor changes in a payer’s portal/website. Such complexity, combined with manual processes and workarounds like EHR bolt-on solutions for managing claims, is a recipe for numerous avoidable denials.

- Against this backdrop, denials are in fact rising. The American Hospital Association found that 89% of healthcare organizations had seen increased denials from 2016 to 2020. Prior authorizations have been a leading cause of this spike. Moreover, many of these denials are never reworked. Read more about why healthcare claims denials are at an all-time high.

- Automation solutions for claims processing don’t always go far enough to solve such problems. Traditional RPA in particular requires significant work to script and maintain. Because it doesn’t adapt in any way into actual events, its bots can easily break, necessitating manual intervention and expensive fixes that negate the benefits of automated claims processing.

The goal is automated claims processing, but with automation that is robust and changeable, not fragile and static, like traditional RPA. Enter healthcare-specific generative AI and large language models — two keys to an effective claims automation solution.

There has been a clear rise in denials in recent years, and it underscores the growing need for a fresh approach to providers processing claims. Given the dynamic nature of revenue cycle management, any breakthrough solution must be capable of continuously learning and performing these revenue cycle activities, offering an automated process that truly supports the human staff at hospitals and health systems.

~ Amy Raymond, SVP of Revenue Cycle Operations and Deployment

Using AI-Driven Automated Claims Processing for Faster Payment

AI can perform a wide variety of tasks that would otherwise require human intelligence, such as making decisions and recognizing objects in images. In healthcare, the possibilities include actions at every stage of the revenue cycle, such as:

- Getting patient insurance information directly from their cards to simplify registration and scheduling and prevent data entry errors.

- Checking all prior authorization requirements to determine if patient care will receive full reimbursement.

- Comprehensively managing claim statuses, to see which ones require follow-up or received no response, and in turn, accelerate cash flow.

- Fulfilling requests delaying payment

- Working denials more timely than healthcare staff are able to get to them

- Completing additional documentation requests for itemized statements or medical records.

- Handling adjustments after a denial in claim processing, liberating human staff from having to do so manually.

Large language models (LLMs), an advanced form of machine learning, learns and improves without the need for frequent direct intervention, further strengthens these functions, making them highly adaptable as EHR and billing systems and payer sites all change.

At the same time, AI and LLMs work in tandem with the judicious application of human intervention. A human-in-the-loop system can handle the edge-case claims that algorithms aren’t 100% ready to solve yet, resolving such issues and then instilling that expertise into the system for the future. They also provide health systems with the correct results, while never requiring staff intervention.

For providers and their staff, the effects of healthcare automated claims processing on payment are profound. Payments that would have gotten delayed or never received at all can now be realized on the first pass, thanks to cleaner claims. Time lost to manual claims processing can be reclaimed.

Superior claims processing is possible through the generative AI-powered AKASA platform. The AKASA platform combines GenAI and large language models with human experts-in-the-loop to offer a sustainable way forward for RCM operations.

Schedule your demo today to learn more.