The Gist

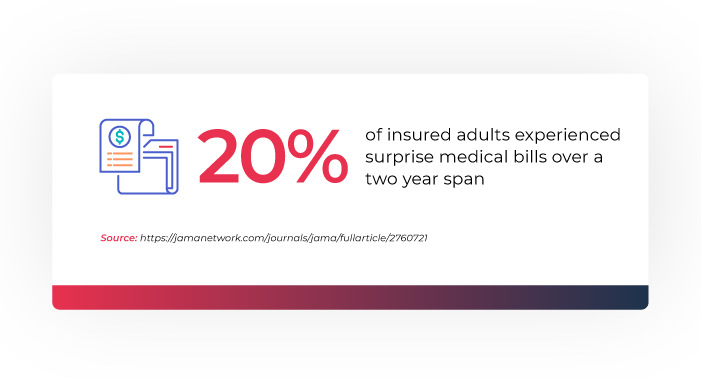

Surprise medical bills are never pleasant, leaving patients with financial burdens they didn’t expect. Oftentimes these bills go unpaid, too, which impacts the credit of the patient and costs the healthcare system. With healthcare systems often struggling to find enough funding as is, surprise medical bills are a lose-lose for everyone involved. Fortunately, there are ways providers can help prevent, or at least alert patients to, surprise medical bills.

A patient’s healthcare experience is shaped by the care they receive and the support they get from healthcare’s administrative function. From the time they schedule an appointment to the bill they receive after a visit or procedure, being proactive and transparent with patients on the financial aspects can go a long way in creating goodwill and demonstrating how providers have the patient’s best interest at heart.

Regulators are not sitting on the sidelines in the push to protect patients from unexpected financial burdens stemming from medical care as the Biden administration moves forward with sweeping new measures aimed at protecting Americans from surprise medical bills.

In the wake of these new regulations, hospitals and health systems should be examining their billing processes from the moment a patient schedules an appointment or tries to access urgent care to minimize surprise bills.

Learn more about the four biggest barriers to preventing surprise medical bills here.

Think of the family whose newborn is in the NICU and just wants to take their child home, safe and healthy. The patient’s family is in a highly vulnerable position. The last thing on their minds is negotiating with insurance or zeroing in on whether they’re eligible to receive care from specialists.

A patient-first policy requires taking a close look at revenue cycle operations as this function serves as the foundation for the patient’s financial experience with providers. Hospitals and health systems should employ new strategies and processes to proactively mitigate unexpected charges and ensure compliance with new federal mandates. This should include doubling down on financial counseling staff and investing in the right technology to prevent surprise medical bills from reaching patients.

Below are three areas within revenue cycle operations that play a crucial role in providing a positive patient financial experience.

Overhaul Your Financial Clearance Process

Financial clearance is a process that determines a patient’s ability and likelihood to pay, and ensures they are notified and are prepared to financially cover the cost of their services. The best way to do this is to:

- Be transparent ahead of time, as early as possible with the patient on what they should expect their bill to be, especially on significant procedures or services

- Provide financial counseling for families in need of guidance during these stressful times

Unfortunately, while the above methods help better the patient experience, most revenue cycle teams are often scrambling to tackle other tasks—navigating scheduling amid trying to get patients cleared by insurance companies for services to be rendered and have limited time or bandwidth to be proactive with patients on their bills.

By leveraging advanced generative AI (genAI), health system leaders can help elevate staff by shifting their time and focus to more challenging work, or retrain existing staff to provide financial counseling – this both enhances operations and improves the overall patient financial experience.

Determine Eligibility for Major Procedures as far in Advance as Possible

Often times, front-end revenue cycle teams are only able to work 2–3 days out to obtain prior authorization from insurers for services like surgery, which leads to a scramble and creates headaches like unexpected, out-of-network charges for patients.

The right AI-powered solution can help revenue cycle staff determine accurate cost estimates, predict denials, and determine the financial resources a patient will need weeks ahead of the scheduled service.

Read more about why denials are at an all-time high — and what health systems can do about it.

Set Industry-Standard Early Eligibility

Before a patient steps foot in the doctor’s office or place of service, a best practice is to confirm their insurance to avoid headaches for both patients and providers. An AI-powered solution can help flag issues like out-of-network providers and bring them to a patient’s attention in advance.

The complexity of healthcare reimbursement drives up hidden costs that affect what every consumer pays and erodes the trust people have in our healthcare system. To put it in perspective, the U.S. spent about $3.8 trillion on healthcare in 2019, or approximately $11,582 per person, according to the Centers for Medicare and Medicaid Services.

A 2019 study published in JAMA estimates that administrative costs account for $266 billion of wasteful spending in healthcare annually. The complex and highly manual claim preparation and billing process is a key driver of healthcare costs in the U.S.

It’s a massive, deeply embedded problem. Striking a balance between managing the financial margins while delivering optimal care is one of the most difficult challenges for industry leaders.

To protect patients from erroneous, surprise medical bills at-scale, solutions are needed to address the root causes of the problem. When genAI is embedded to make revenue cycle operations more efficient and accurate, it can help ensure patients get the care they need without surprise medical bills.

AKASA’s platform uses advanced genAI and large language models, coupled with human experts-in-the-loop, to provide end-to-end streamlining of healthcare RCM processes. This allows your team to spend less time on box-checking tasks, and focus on quality and providing the best patient experience possible.

See how AKASA can help you and schedule a free demo today.

Amy Raymond serves as the senior vice president of revenue cycle operations and deployments at AKASA, where she maintains operational responsibility for the production and performance of the firm’s AI-driven automation platform. Across her 25-year career in revenue cycle, Raymond has held several leadership, consulting, and implementation roles. Her industry experience includes tenures at national and regional health systems, as well as numerous care settings and specialties. Most recently, Raymond served as a senior leader in the revenue cycle technology vertical at Advisory Board. Her extensive professional expertise includes: end-to-end revenue cycle operations, process redesign/optimization, patient financial experience improvement, technology deployment/adoption, change management, and employee engagement. As a military spouse, Raymond is a passionate advocate for mil-spouse hiring and community support.